By Spencer Gray

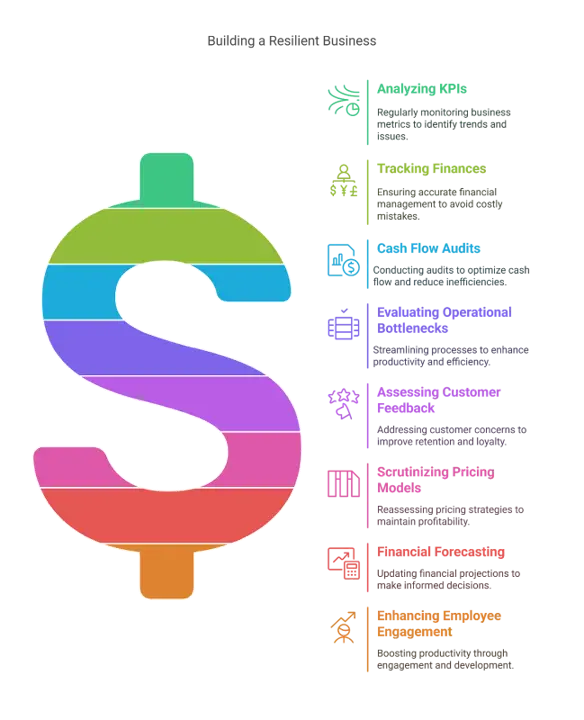

No matter how successful, every business has weak points that can hinder growth and profitability. Recognizing and addressing these vulnerabilities is crucial for long-term sustainability. Operational inefficiencies can drain resources, while financial missteps can erode profits. A proactive approach helps you streamline processes, optimize cash flow, and fortify your business against unexpected challenges. Below are key strategies to identify and improve your business’s weak areas.

Analyzing Key Performance Indicators (KPIs) Regularly

Your business metrics tell a story, but only if you’re paying attention. Monitoring key performance indicators (KPIs) helps you identify trends, inefficiencies, and potential problem areas before they become serious issues. Consider financial ratios like profit margins, inventory turnover, and debt-to-equity levels to assess financial health

Tracking Your Finances

Failing to track your finances properly can lead to costly mistakes, from miscalculating taxes to overlooking unpaid invoices. Investing in accounting software helps you avoid these errors by automating financial tracking and ensuring accuracy. Instead of paying for expensive solutions, you can opt for free software with essential features like invoicing, expense categorization, and tax deduction tracking. Using a cost-effective tool maintains financial clarity while keeping overhead expenses low.

Performing a Cash Flow Audit

Cash flow is the lifeblood of your business, and mismanagement can quickly lead to

insolvency. Conducting regular cash flow audits helps you pinpoint where money is being spent inefficiently. Identify recurring expenses, such as unused software subscriptions or excessive supplier costs, that could be reduced or eliminated. Delayed customer payments can also create bottlenecks, so consider tightening credit policies or offering incentives for early payments. By improving cash flow management, you ensure stability and the ability to invest in growth.

Evaluate Operational Bottlenecks

Operational inefficiencies can quietly drain resources and reduce profitability. Examine

workflows to find bottlenecks that slow down productivity:

- Do you have overly complicated specific processes?

- Could manual approval systems be automated?

- Are outdated systems creating unnecessary delays?

Mapping out your workflows can highlight areas where automation, outsourcing, or restructuring could increase efficiency. A streamlined operation saves time, reduces costs, and allows your team to focus on more strategic tasks.

Assess Customer Feedback and Retention Rates

Your customers often reveal weak points in your business without you realizing it. Low retention rates, negative reviews, or frequent complaints indicate service gaps that need addressing. If customers are leaving for competitors, find out why. Conduct surveys, analyze support tickets, and review feedback to spot recurring issues. Sometimes, the problem is as simple as poor communication, slow response times, or outdated products. Strengthening customer experience improves loyalty, which ultimately enhances financial stability.

Scrutinize Pricing and Profitability Models

Your pricing strategy directly impacts profitability, but it’s easy to set and forget it. If your profit margins are shrinking, it might be time to reassess how you price your offerings. Compare your costs with competitors and market demand to determine if adjustments are necessary. Avoid competing solely on price because value-driven pricing often leads to healthier margins. Additionally, if certain products or services are underperforming, consider discontinuing or repositioning them in the market.

Strengthen Financial Forecasting and Budgeting

A lack of financial foresight is a common weak point for businesses. Without accurate

forecasting, you may overspend during downturns or underinvest during growth

opportunities. Regularly update financial projections based on current market trends and past performance. Budgeting software is used to track spending and adjust allocations as needed. A proactive financial strategy allows you to prepare for potential downturns, secure necessary funding, and make data-driven investment decisions.

Improve Employee Productivity and Engagement

Your workforce plays a critical role in operational efficiency. Performance will suffer if employees are disengaged, overworked, or unclear about their responsibilities. Regular performance reviews, clear communication, and investing in professional development can boost productivity. Consider leveraging technology to automate repetitive tasks, allowing employees to focus on high-value work. Engaged employees work more efficiently and contribute ideas for improving business processes.

Addressing operational and financial weaknesses requires ongoing effort; the payoff is a more resilient and profitable business. By monitoring KPIs, improving cash flow, streamlining operations, and optimizing pricing, you position yourself for sustained success. Engaging employees and prioritizing customer feedback further strengthens your foundation. Taking a proactive stance now ensures that your business remains agile and competitive in the face of future challenges.